Bits of Bitcoin Research (BBR) - Issue 22 - Special Issue: Own New Research

Bitcoin Hashrate Dynamics: Price, Revenue Correction, and Evolution

This issue is a special issue to me, as I am not presenting other research as usual but my own research that I worked on with Dr. Teo Geldner.We document how the response of Bitcoin mining (Hashrate) to price has fundamentally transformed over 15 years (2010-2025), using a Time-Varying Parameter SVAR with Stochastic Volatility model that captures continuous evolution in these relationships.

I am excited that I can now share our latest research paper “Bitcoin Hashrate Dynamics: Price, Revenue Correction, and Evolution - A Time-Varying Parameter SVAR Stochastic Volatility Analysis”.

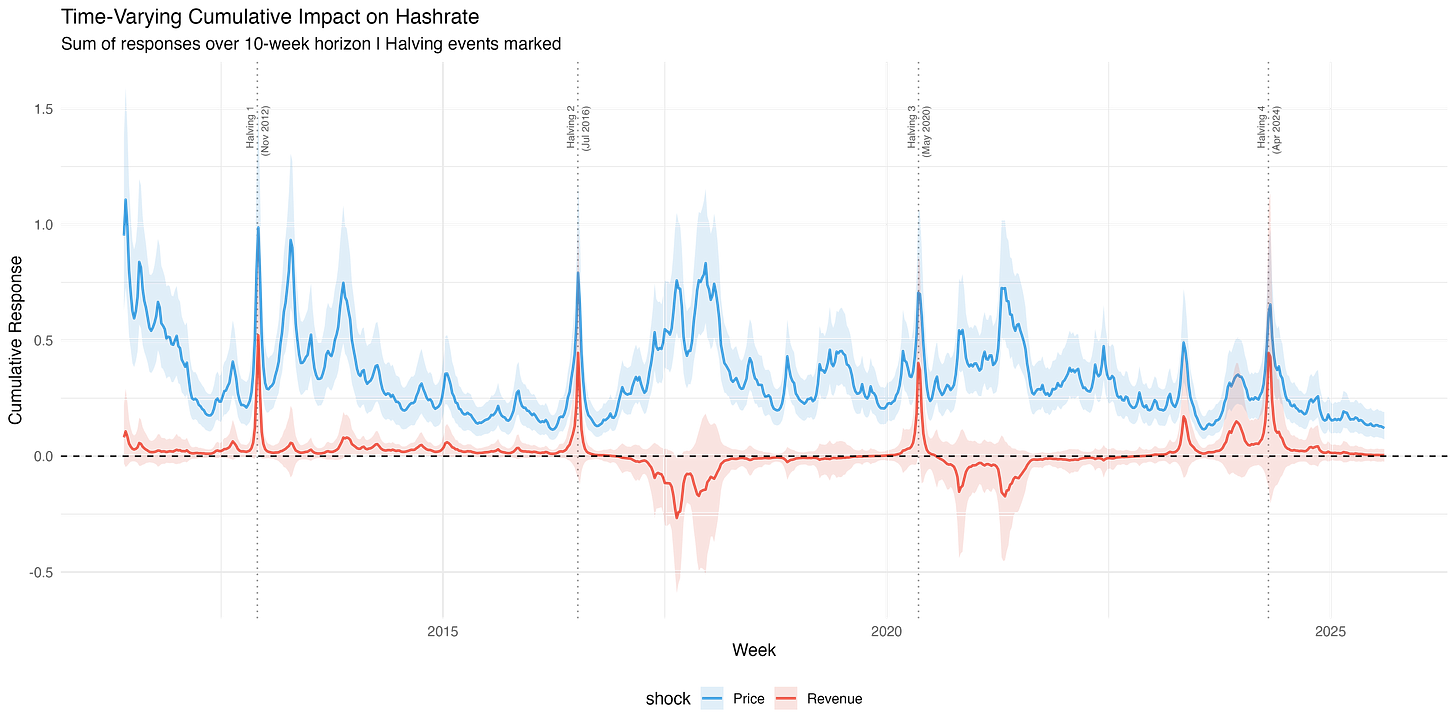

We document how the response of Bitcoin mining (Hashrate) to price has fundamentally transformed over 15 years (2010-2025), using a Time-Varying Parameter SVAR with Stochastic Volatility model that captures continuous evolution in these relationships.

The core finding:

The hashrate’s response to price has evolved from volatile, speculative reactions to stable, professionalized operations.

Early-period price responses (2012-2013) exceeded recent years (2023-2025) by 142% at daily frequency. Week-1 effects declined from 0.150 (January 2012) to 0.046 (January 2025), while cumulative 10-week effects dropped from 0.519 to 0.163.

This decline reflects the maturing of Bitcoin mining. The results suggest that early mining participants made quick on/off decisions in response to price movements, and a few miners could likely cause large hashrate fluctuations. Today’s mining involves systematic capacity planning with longer investment horizons, reflecting the capital-intensive nature of modern mining infrastructure.

Note: Price consistently drives hashrate (blue line) throughout Bitcoin’s history, with effects moderating over time as mining matured. Revenue shows no systematic transmission (red line remains statistically insignificant near zero throughout).

Price, not revenue, drives capacity

Throughout Bitcoin’s history, price consistently drives hashrate. A one-standard-deviation price shock generates cumulative responses of 0.034 standard deviations over 30 days (daily) and 0.292 over 10 weeks (weekly). While these magnitudes indicate inelastic supply, they represent economically meaningful transmission given mining’s substantial fixed costs and operational constraints.

Revenue shows no independent effect once properly measured.

Correcting the revenue measurement problem

Daily mining revenue mechanically incorporates realized hashrate through blocks mined. More hashrate means more blocks discovered, mechanically increasing total revenue.

Our solution: normalize revenue to Bitcoin’s protocol target of 144 blocks per day. Once corrected, revenue shows no independent systematic effect. Miners respond to sustained price developments, not realized revenue outcomes.

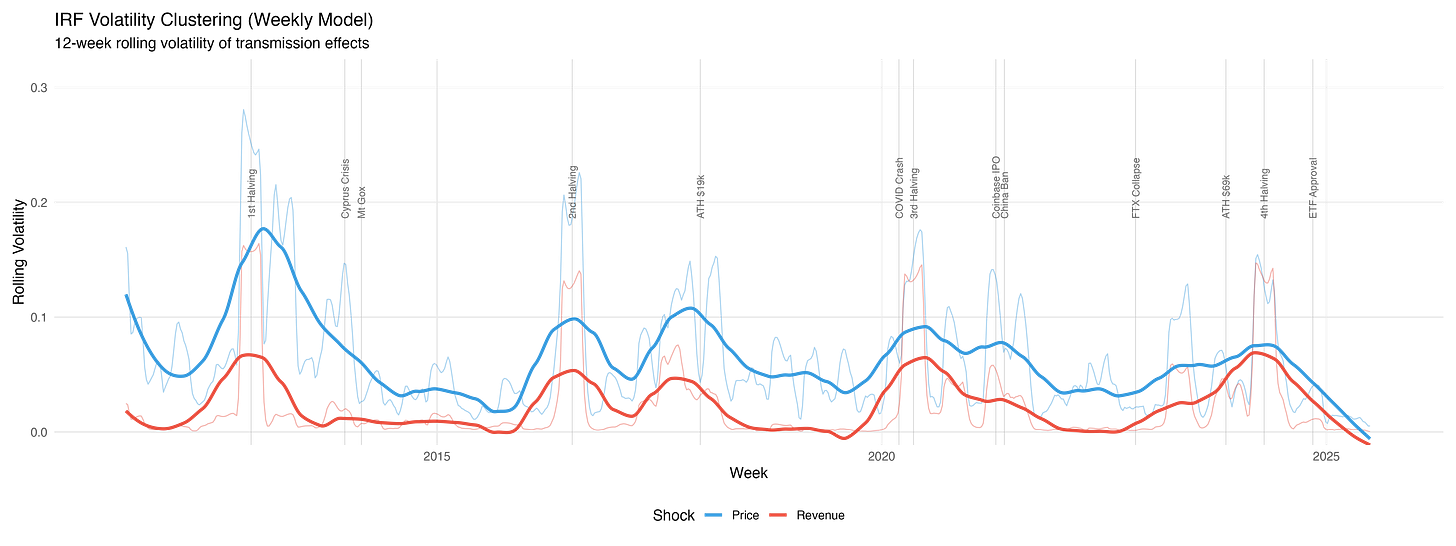

Methodology: Why Time-Varying Parameters matter

Bitcoin in 2010 operated under fundamentally different conditions than Bitcoin in 2025. Standard econometric models assume constant parameters across the entire sample, which forces the same relationships to hold throughout. This assumption is unrealistic given Bitcoin’s fast-paced evolution.

Time-Varying Parameter SVAR with Stochastic Volatility allows both the transmission mechanisms and their volatility to change continuously. There are no arbitrary regime shifts or period definitions. The model captures gradual, systematic changes as the mining industry changes and becomes more professionalized.

We validate findings across daily and weekly frequencies, confirming results reflect genuine economic relationships rather than measurement artifacts.

Note: Price transmission volatility has systematically declined as mining matured, moving from high volatility in early years to stable, low volatility in recent periods. This reflects the transition from speculative reactions to professionalized operations.

Summary

Hashrate responds to price developments with inelastic but economically meaningful effects. These responses have moderated over time while remaining statistically significant, documenting the mining transition from volatile early-period reactions to more stable recent-period patterns. Revenue shows no independent effect once simultaneity bias is addressed.

The continuous evolution of these transmission mechanisms means that monitoring shifts and trends in the price-hashrate relationship remains relevant for understanding mining dynamics.

I hope you find our research insightful and that you enjoyed this special issue.

Feedback welcome.

Paper details

Wüstenfeld, Jan and Geldner, Teo, Bitcoin Hashrate Dynamics: Price, Revenue Correction, and Evolution - A Time-Varying Parameter SVAR Stochastic Volatility Analysis (November 22, 2025). Available at SSRN: https://ssrn.com/abstract=5786322