Bits of Bitcoin Research (BBR) - Issue #3

Load Balancing, Microgrids in Africa, Bitcoin as Payments

Hi everyone,

Welcome to the third issue of Bits of Bitcoin Research. In this issue, we look at three significant developments:

Load Balancing: An academic analysis highlighting the importance of large flexible loads and showcasing how Bitcoin mining provides critical power system flexibility in the US through its ability to adjust load demand, with miners like Riot accommodating at times 95% load reduction during peak demands

Microgrids in Africa: An industry report on rural electrification in Africa using Bitcoin mining—potentially one of the most transformative applications for bringing electricity to millions by making minigrids economically viable

Bitcoin as Payments: A comprehensive market report demonstrating that Bitcoin is indeed functioning as a currency today, with millions of real-world transactions occurring across retail, e-commerce, and international payments

Paper 1 (Research Paper): Rethinking Load Growth: Assessing the Potential for Integration of Large Flexible Loads

Norris, T. H., Profeta, T., Patino-Echeverri, D., & Cowie-Haskell, A. (2025). Nicholas Institute for Energy, Environment & Sustainability, Duke University. https://nicholasinstitute.duke.edu/sites/default/files/publications/rethinking-load-growth.pdf

This analysis assesses the US electrical power system's capacity to accommodate new flexible loads through strategic curtailment. With rising energy demand from data centers and varying flexibility in energy consumption, this becomes challenging for American energy grids.

This continues themes from Issue #2, where we discussed Lal et al. ‘s (2024) work showing how Bitcoin mining could optimise renewable energy installations. It also builds on the grid stabilisation benefits highlighted in Dewhurst's (2025) research from Issue #1, which demonstrated how Bitcoin mining saved Texans $18 billion by providing flexible demand response capabilities.

Bitcoin mining emerges as one of the leading flexible load-balancing solutions, unlike other data centers that cannot easily be powered down. The main findings indicate that one Bitcoin miner stands out in particular.

Main Findings:

At times, the Bitcoin miner Riot managed to accommodate a 95% reduction in load during peak demand at the ERCOT grid

76 GW of new load (10% of current peak demand) could be integrated with only 0.25% annual curtailment

Most curtailment hours maintain significant load availability (88% retain at least 50%)

Average curtailment duration is relatively short (1.7-2.5 hours depending on scenario)

Five largest balancing authorities (PJM, MISO, ERCOT, SPP, Southern Company) offer 61 GW of potential at 0.5% curtailment

Data:

Nine years of hourly load data (2016-2024)

22 balancing authorities covering:

Seven RTO/ISOs

Eight non-RTO Southeastern BAs

Seven non-RTO Western BAs

744 GW of total summer peak load (95% of continental US)

Methodology:

Analysis of system headroom through "curtailment-enabled headroom" metric

Evaluation of seasonal and aggregate load factors

Computation of curtailment requirements under different scenarios

Goal-seek optimisation to determine maximum load additions

Assessment of curtailment magnitude, duration, and seasonal patterns

Why is that important?

This research is important as US load growth faces considerable infrastructure constraints. With NERC forecasting a 21.5% increase in winter peak load growth over the next decade and data centres accounting for up to 44% of new demand, strategic flexibility through Bitcoin mining could utilise existing grid capacity to accommodate substantial new load growth.

This connects directly to our Issue #2 coverage of the Berkeley study (Gorman et al., 2024), highlighting significant challenges in deploying renewable energy in the US, including a 70% increase in grid connection times over the past decade. As the authors noted, Bitcoin mining provides a strategic approach to tackling financial obstacles in deploying clean infrastructure by generating interim economic value from renewable projects that aren't yet grid-connected.

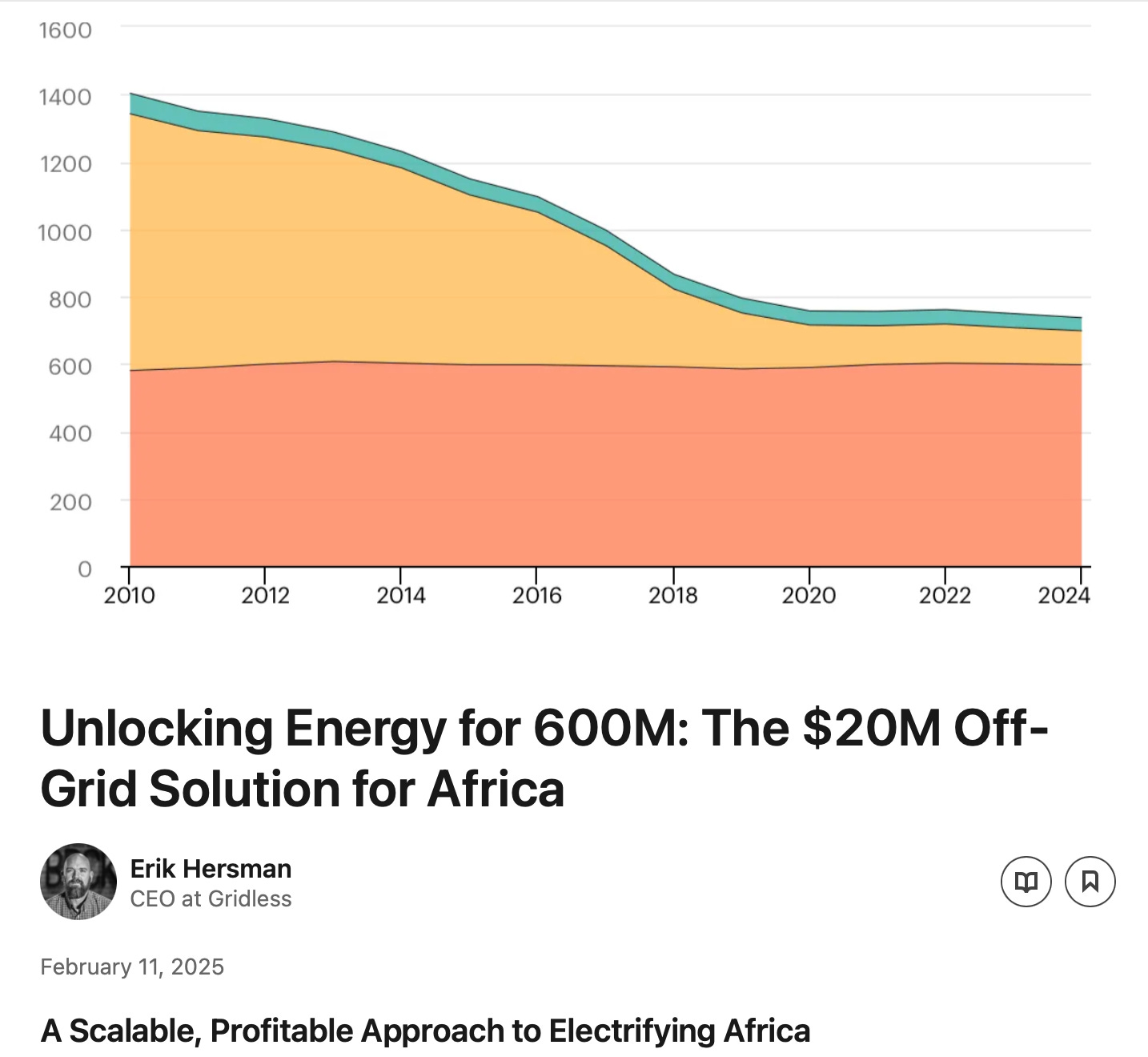

Paper 2 (Industry Report): Bitcoin Mining as a Catalyst for Rural Electrification in Africa

Hersman, E., Gridless. (2025). Unlocking Energy for 600M: The $20M Off-Grid Solution for Africa. https://www.linkedin.com/posts/erikhersman_bitcoin-isnt-just-a-savings-and-money-tool-activity-7295078247543824384-ZpAl/

Following our previous examination of Bitcoin mining's role in US renewable energy (Lal et al., 2024), where mining proved profitable in 80 of 83 assessed renewable installations, this analysis extends similar principles to the unique challenges faced by Africa.

Key Points:

Despite having 17% of the world's population, Africa accounts for just 4% of global power supply investment

Only 10% (40GW) of Africa's 400GW hydroelectric potential has been developed

Traditional minigrid economics have failed to serve 600M Africans without electricity:

140,000 minigrids needed but only 5,000 built (less than 5% of requirement)

Rural customers pay $0.36-1.00/kWh versus $0.22/kWh for grid power

72% of minigrid financing relies on concessionary funding

Bitcoin mining as an anchor tenant enables:

5-7 year ROI on hydro minigrid developments

Price floor of $0.06-0.11/kWh through global energy market arbitrage

An initial $20M investment can develop up to 148x more energy over 30 years

Reduction in development costs from $2.2B to $110M through capital efficiency

Why is that important?

In my view, this represents one of the most significant use cases of Bitcoin mining to date, extending beyond just the mining of Bitcoin and its environmental impact.

Whereas previous efforts to finance and establish microgrids have faltered due to poor economics and sluggish demand growth, Bitcoin mining has the potential to revolutionise the economic landscape of renewable energy development, providing electricity to millions neglected by traditional models.

Mining could facilitate access to electricity for hundreds of millions by making previously unviable minigrid investments profitable. This would be done without subsidies or development financing, relying solely on market dynamics.

Paper 3 (Market Report): Bitcoin Payments - From Digital Gold to Everyday Currency

Stagg, D., & O'Prey, D. (2025). Bitcoin Payments: From Digital Gold to Everyday Currency. Breez Technology. https://breez.technology/report/

One narrative today suggests that Bitcoin, as a currency, has failed and is merely regarded as digital gold, an investment, or a speculative asset. But is this really the case?

Stagg and O'Prey illustrate that this is false. Bitcoin is actively employed as a currency in daily transactions by millions across the globe.

It builds upon several themes explored in previous issues: Bitcoin's role in emerging economies (Issue #1), its relationship with market uncertainty (Issue #2), and its increasing significance in real-world applications.

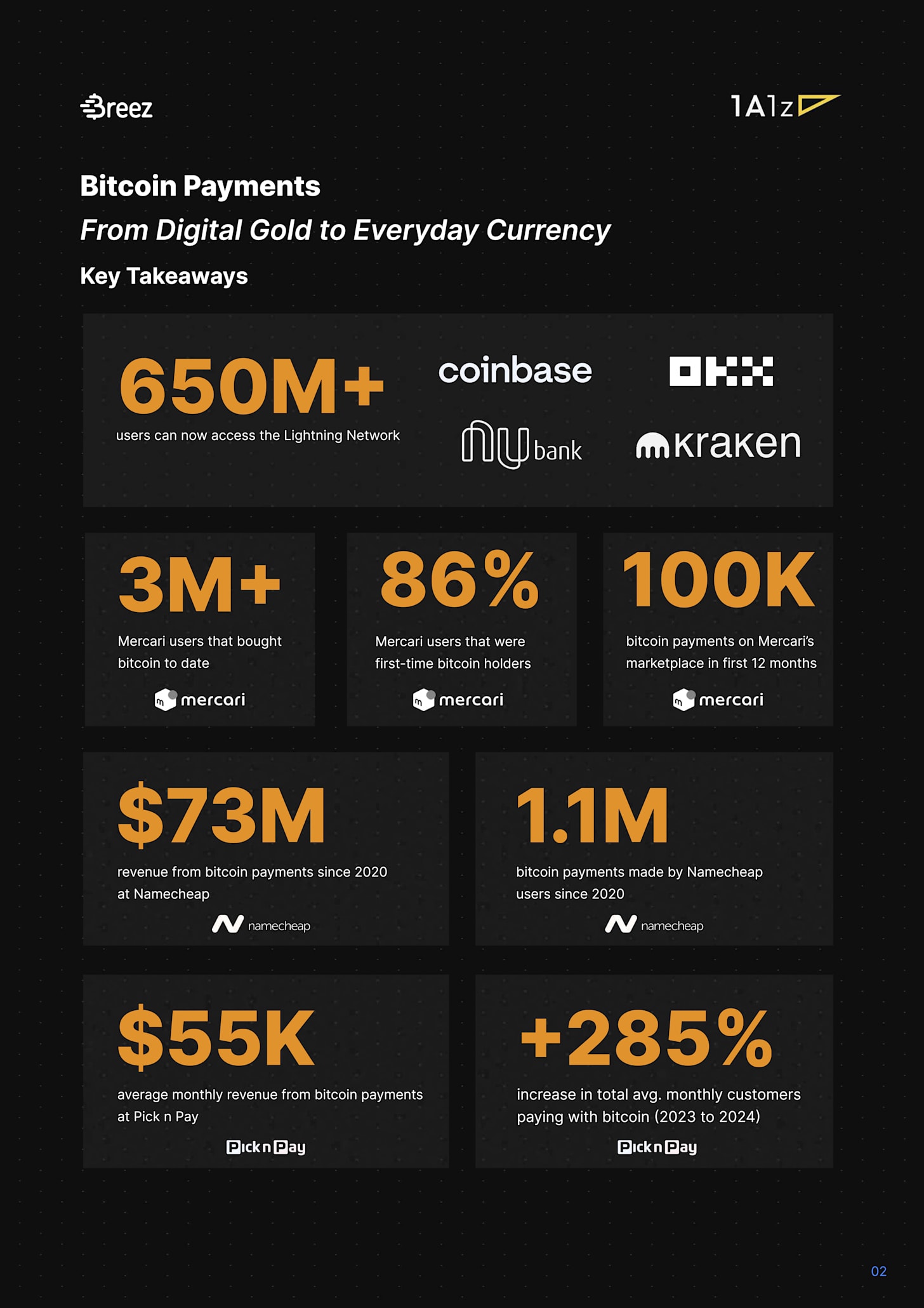

Main Findings:

The Lightning Network now reaches over 650 million users globally through integrations with mainstream products and growing merchant adoption

Major companies showing successful Bitcoin payment adoption:

Mercari: 100,000 Bitcoin payments in first month, 86% first-time Bitcoin holders

Namecheap: $73M revenue from Bitcoin since 2020, 1.1M transactions

Pick n Pay: 285% increase in customers paying with Bitcoin (2023 to 2024)

Beyond traditional payments, Lightning enables new models like:

Streaming payments for pay-per-use services

Micropayments that make even the smallest exchanges viable

Real-time global transfers without intermediaries

Why is that important?

Bitcoin payments are a practical reality happening today. The Lightning Network has made transactions faster, cheaper, and more scalable. Companies are processing millions of Bitcoin transactions worth tens of millions of dollars—not speculatively, but in everyday commerce.

It is an essential step in Bitcoin's journey towards broader adoption and greater relevance to the real world beyond its role as a savings technology.

This data links to previously discussed research. It demonstrates that Bitcoin has evolved from the hedge against uncertainty discussed in Issue #2 (Miba'am & Güngör, 2025) into a practical medium of exchange. Furthermore, it builds on the ECB’s findings from Issue #1 regarding Bitcoin's significance in emerging economies. Lightning's instantaneous, low-cost transactions tackle many of the financial access challenges identified in those regions.

Here are some additional interesting statistics on payments during the Adopting Bitcoin 2025 C

onference in Cape Town:

Wrapping Up

This issue combines academic research and industry reports to continue exploring several themes we've explored since the newsletter’s launch: Bitcoin's role in renewable energy development, its importance in emerging markets and developing countries, and its evolution as a financial tool.

A picture emerges of Bitcoin's multifaceted real-world utility: stabilising power grids, making rural electrification viable in underserved regions, and functioning as an actual currency in millions of everyday transactions. These findings challenge simplistic narratives about Bitcoin and demonstrate its concrete impact far beyond theoretical use cases or its original conception as digital gold.

Have a great week!

As always, don't trust; verify!

Thanks for sharing Jan ⚡️