Bits of Bitcoin Research (BBR) - Issue #13

Bitcoin Adoption in the US and Media Narratives: What You Consume Matters

Welcome to Issue #13 of Bits of Bitcoin Research, your curated guide to cutting-edge insights on Bitcoin.

In this issue, we examine two reports from the Bitcoin space, with the first one covering demographics of Bitcoin adoption in the US and the second analysing how mainstream media covers or does not cover Bitcoin.

Let's dive into the reports.

Report 1: Bitcoin Goes Mainstream – Survey Insights into the Demographics of American Adoption

Cross, T., & Perkins, A. (2025). Understanding Bitcoin Adoption in the United States: Politics, Demographics, & Sentiment - Q3 2025. The Nakamoto Project. Available at: https://www.thenakamotoproject.org/report

The second survey by The Nakamoto Project, conducted in March 2025, of 3,538 Americans offers insights into Bitcoin ownership patterns and presents counterintuitive findings about who owns Bitcoin and why.

Key Findings:

48 million Americans own Bitcoin in some form (18.6% of adults)

11 million Americans keep Bitcoin in self-custody (4.21% of adults)

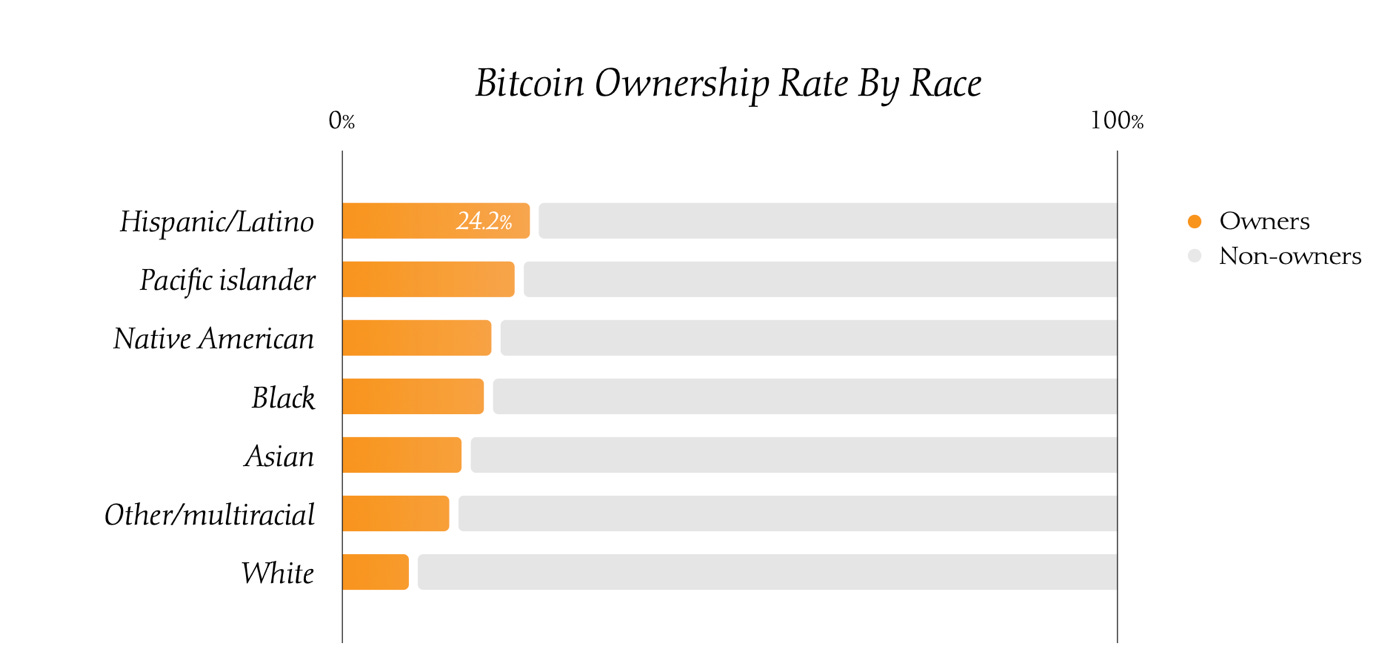

Demographic shifts show Bitcoin owners are becoming younger, more male, and increasingly non-white.

Political evolution from neutral to a slight rightward shift, but ownership spans the entire spectrum and is not as politicised as it may be portrayed in the media and social media.

Demographic Patterns

Bitcoin ownership continues to skew:

Younger: Highest adoption rates among Americans under 35

Male: A significant gender gap remains with more male than female indicating to own Bitcoin

Non-white: Significantly higher adoption rates compared to previous surveys

Politically diverse: Despite a slight rightward movement, owners remain predominantly moderate

Distinctive Moral Profile

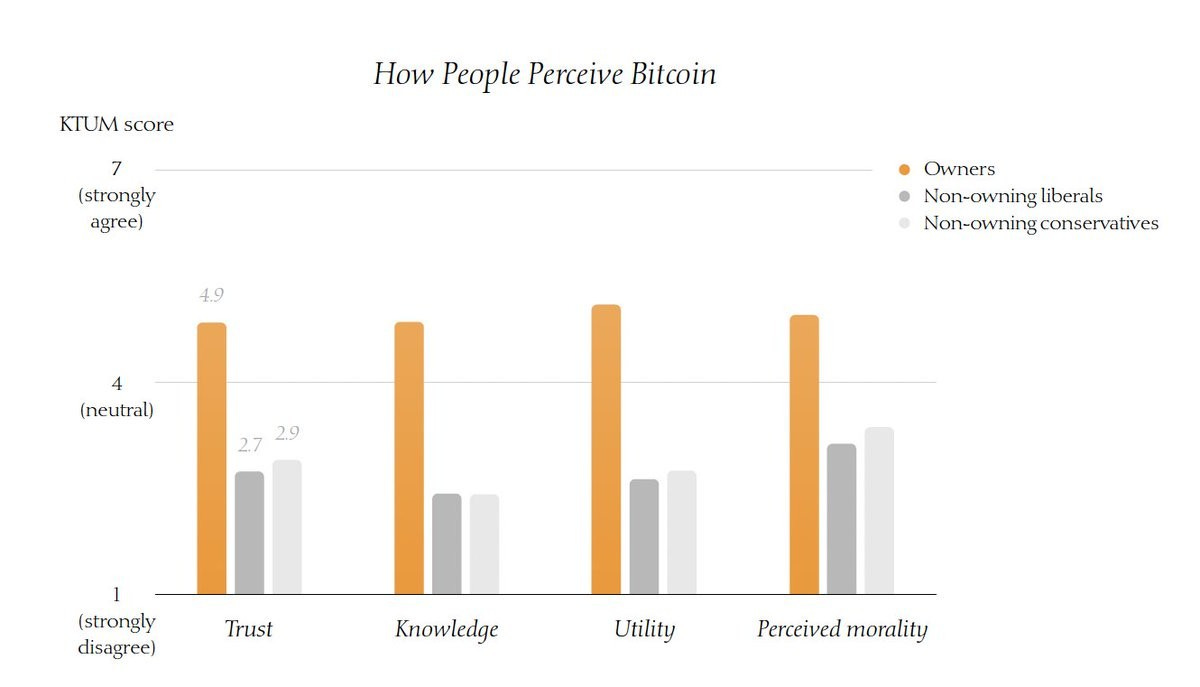

Using Moral Foundations Theory, the report finds that Bitcoin owners scored higher than both liberals and conservatives on most moral dimensions:

Care and equality

Proportionality and loyalty

Purity and cultural liberty

This pattern suggests Bitcoin appeals to individuals with heightened moral concern across multiple dimensions rather than narrow ideological positions.

Attitudes vs. Demographics

The study's central finding: demographic factors are less predictive of Bitcoin ownership than attitudes about the technology itself.

While age, gender, race, and politics correlate with ownership, they don't predict it as strongly as:

Knowledge about Bitcoin

Trust in the technology

Belief in its utility and moral value

This is an important finding as it shows that education is key.

Why This Matters

The survey results suggest that Bitcoin adoption has reached a significant mainstream level, while still being mainly driven by knowledge and experience rather than political identity.

These findings directly connect to the next report. If education is a key factor in determining Bitcoin ownership, the media you consume will likely also influence your perception of Bitcoin and your decision to own Bitcoin.

Report 2: Coverage Patterns Across Mainstream Media

Bitcoin Perception. (2025). Q2 2025 Mainstream Media Bitcoin Coverage Report. Available at: https://bitcoinperception.com/q2-2025-mainstream-media-bitcoin-coverage-report/

The Mainstream Media Bitcoin Coverage report analyses 1,116 Bitcoin articles across 18 major outlets for Q2 of 2025. The report shows significant variations in coverage volume and sentiment.

Coverage Volume Gaps

„Elite“ financial publications provided minimal Bitcoin coverage:

Wall Street Journal: 2 articles

Financial Times and New York Times: 11 articles

The authors describe the ignorance of Bitcoin as a failure of legacy financial media to meet their readers‘ informational needs.

Other finance-focused outlets filled this information gap with constructive coverage left open by the above-mentioned media outlets.

Forbes: 194 articles (97x more than WSJ)

CNBC: 141 articles (70.5x more than WSJ)

Fortune: 117 articles (58.5x more than WSJ)

That’s a significant gap in reporting by volume.

Apart from volume, the report splits the media into three coverage categories

High-Volume Constructive Coverage:

Forbes: 43% positive sentiment, comprehensive institutional coverage (24% negative and 33% neutral)

CNBC: 42% positive sentiment, strong banking and investment focus (17% negative and 40% neutral)

Fortune: a strong neutral coverage with 57%, mining and finance topics (25% positive

Limited Coverage:

Traditional elite publications provided minimal Bitcoin coverage relative to overall financial reporting

High-Volume Mixed or Negative Coverage:

The Independent: 42% negative sentiment, regulatory and security focus (18% positive and 40% neutral

Fox News: Mixed messaging with 38% negative sentiment, 28% positive and 34% neutral

Barron‘s: Mixed messaging with 27% negative, 25% positive and 48% neutral

Information Asymmetry Implications

This variation in coverage means readers of different publications receive significantly different information about Bitcoin's role in financial markets. Investors primarily relying on elite outlets with limited coverage may lack a complete understanding of developments in this asset class. These readers risk being left behind.

Furthermore, the media you consume can influence your opinion of Bitcoin. If you mainly read outlets that portray Bitcoin unfavourably, you are likely to view it negatively, and vice versa.

Why This Matters

The systematic variation in coverage creates potential advantages for investors and institutions that obtain information from outlets providing comprehensive Bitcoin analysis, as opposed to those with a limited focus on the asset class.

Wrapping Up

The above reports provide insights into both Bitcoin adoption and media coverage.

The demographic research indicates that Bitcoin may already have reached a significant number of people in the US, with 48 million American owners from diverse backgrounds. The report confirms their previous findings and challenges the assumption that Bitcoin is just for one political direction.

The finding that attitudes and knowledge are more important than demographics indicates that education remains the main factor driving Bitcoin adoption. This is a key insight because it demonstrates that those developing educational content are essential in reaching the people. It also directly relates to the second report.

If education is a key driver in Bitcoin adoption, the media you consume may draw you into Bitcoin, push you away, or keep you uninformed on the topic altogether.

The analysis reveals significant coverage gaps that may lead to varying levels of market awareness among different readerships. While finance-focused publications provide thorough coverage, traditionally influential outlets show minimal attention despite Bitcoin's increasing market importance.

If there is one thing we can draw from the two reports, it is that we cannot value all the Bitcoin educators out there highly enough who put a lot of time and effort into providing educational content, helping people understand Bitcoin, often for free.

I hope you found this issue insightful.

Until next time—don't trust, verify!