Bits of Bitcoin Research (BBR) - Issue #17

Bitcoin goes Interplanetary and Canadian Consumer Knowledge: Academic Insights into Bitcoin's Technical and Behavioral Frontiers

Welcome to Issue 17 of Bits of Bitcoin Research, your curated guide to cutting-edge academic insights on Bitcoin.

In this issue, we explore a topic that extends beyond Earth and one close to our own: the technical challenges of operating Bitcoin across interplanetary distances, and what drives Bitcoin knowledge among everyday consumers. These papers demonstrate how Bitcoin research continues to push boundaries in both technological and behavioural aspects.

We cover the following two distinct research areas in this issue:

Interplanetary Bitcoin Operations: How Bitcoin could function as a monetary standard between Earth and Mars, including

cryptographic solutions for the unique challenges of space-based transactions.

Consumer Bitcoin Knowledge in Canada: What factors influence both objective and subjective knowledge of Bitcoin blockchain technology among Canadian adults, with implications for education and regulation.

Let's explore these papers.

Paper 1: Bitcoin as an Interplanetary Monetary Standard with Proof-of-Transit Timestamping

Puente, J.E. & Puente, C. (2025). Bitcoin as an Interplanetary Monetary Standard with Proof-of-Transit Timestamping. https://doi.org/10.48550/arXiv.2508.20591

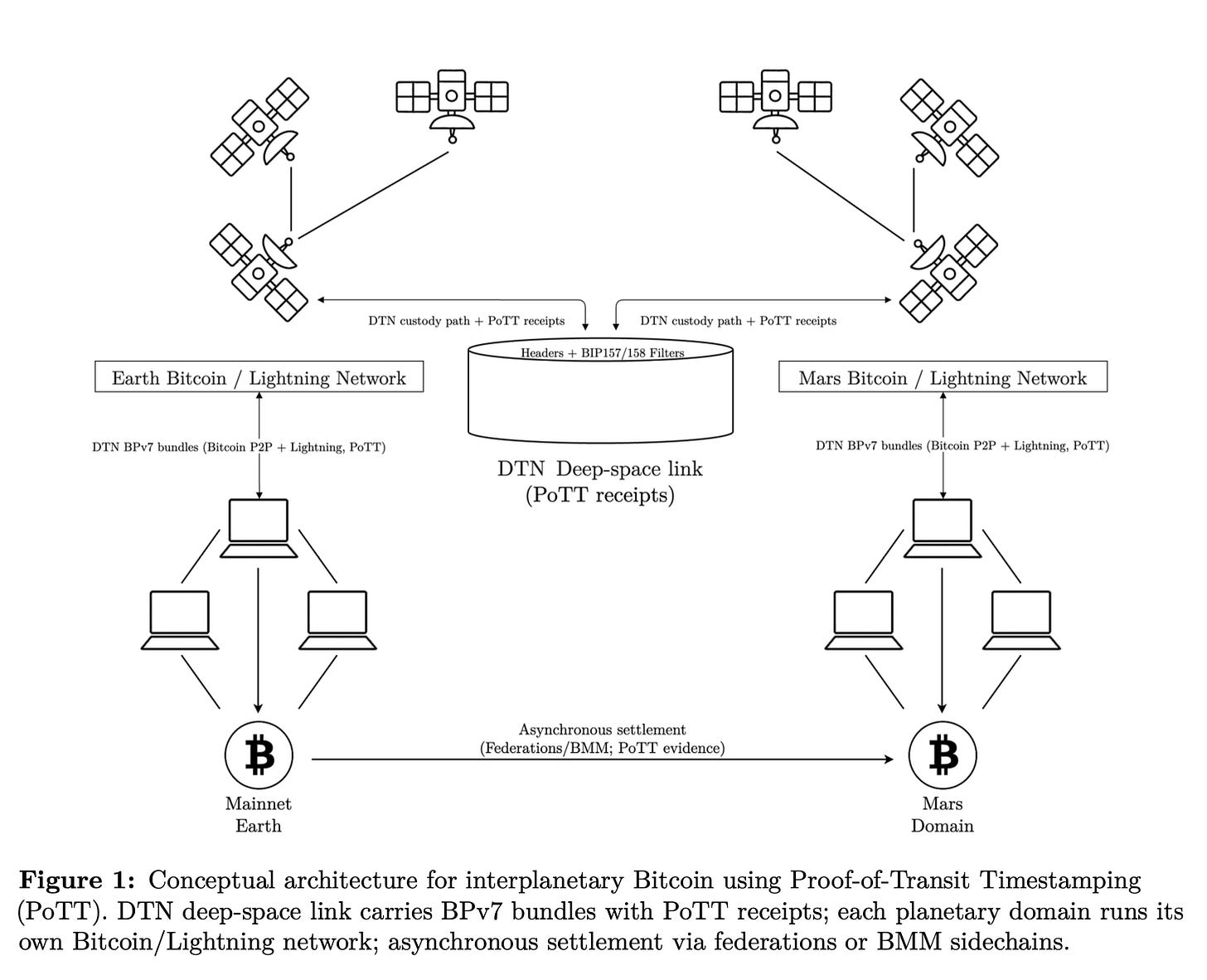

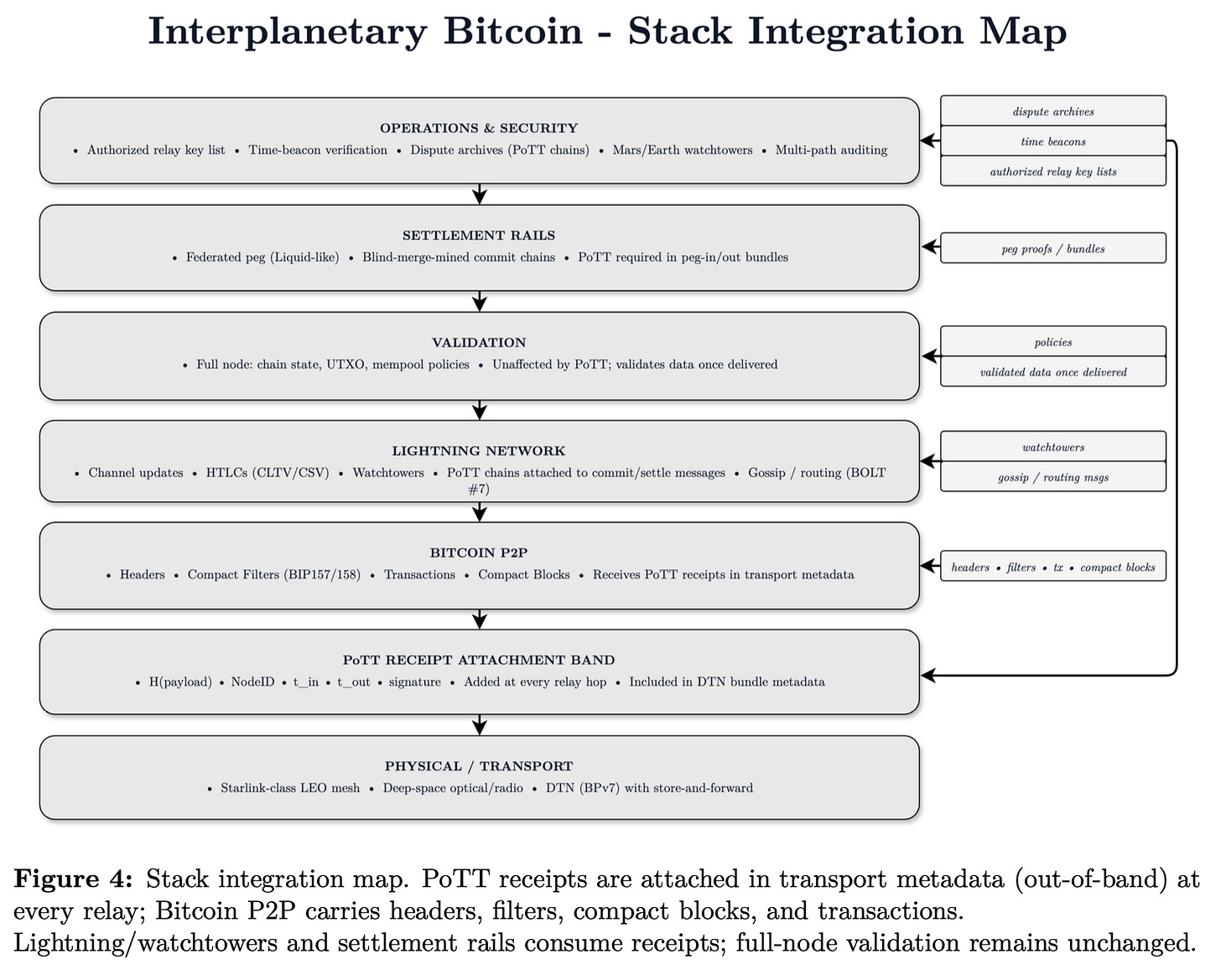

This paper addresses the technical challenges of operating Bitcoin across interplanetary distances, proposing solutions for the constraints imposed by light-speed delays between Earth and Mars.

Key Technical Contributions:

Proof-of-Transit Timestamping (PoTT): A novel cryptographic primitive that creates tamper-evident audit trails for Bitcoin data traveling across high-latency interplanetary links. Each relay node creates signed receipts that form a verifiable chain of custody.

Physics-Aware Architecture: The system accounts for the reality that Earth-Mars communication takes 3-22 minutes one-way, making synchronized mining impossible while preserving verification capabilities.

Header-First Replication: Prioritizes block headers for timely chain awareness, requiring only ~4.2 MB/year bandwidth (≈1.07 bps sustained) for basic operation.

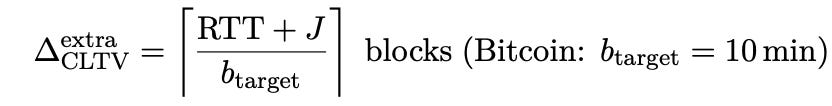

Latency-Aware Lightning: Cross-planet Lightning channels use conservative timelock margins calculated as:

,where CLTV=CheckLockTimeVerify, RTT is round-trip time and J is jitter allowance.

Operational Framework:

The architecture preserves Bitcoin's base layer parameters while adapting higher layers:

Earth Domain: Maintains unchanged Bitcoin L1 as the monetary base

Mars Domain: Operates pegged commit chain or strong federation for local settlement, 1:1 pegged assets

Settlement Rails: Asynchronous cross-planet settlement via federations or blind-merge-mined sidechains

Verification: PoTT-M2 profile requiring ≥3 relays from ≥2 operator domains with independent time beacons (one nachor from each planetary domain)

Why This Matters:

This research demonstrates that Bitcoin's monetary properties can extend beyond Earth without consensus changes. The work provides concrete technical solutions for space-based commerce, showing how cryptographic accountability can substitute for real-time synchronization when physics imposes fundamental constraints.

The paper's approach of keeping L1 unchanged while adapting transport and Layer 2 solutions offers a template for Bitcoin operation under extreme network conditions future-proffing Bitcoin as an interplanetary medium of exchange and store-of-value.

Paper 2: Factors Influencing Knowledge of the Bitcoin Blockchain Among Canadian Adults

Cloutier, J., & Chouinard, H. Factors Influencing Knowledge of the Bitcoin Blockchain Among Canadian Adults. In Proceedings of Economics and Finance Conferences (No. 15116802). International Institute of Social and Economic Sciences.

https://ideas.repec.org/p/sek/iefpro/15116802.html

This empirical study examines what drives Bitcoin blockchain knowledge among 1,078 Canadian adults, distinguishing between objective knowledge (actual understanding) and subjective knowledge (perceived understanding).

Key Findings from Regression Analysis - Objective Knowledge:

Factors that increase objective Bitcoin blockchain knowledge:

Gender: Men show higher objective knowledge levels surrounding the Bitcoin

Self-efficacy: Confidence in ability to learn about cryptoassets, increases objective knowledge

Perceived risk: Higher risk perception correlates with better understanding

Traditional investment knowledge: Prior financial knowledge transfers

Subjective Bitcoin knowledge: Self-assessment aligns with actual knowledge

Key Findings from Regression Analysis - Subjective Knowledge:

Factors influencing perceived Bitcoin blockchain knowledge differ significantly:

Favorable attitude toward cryptoasset investment

Self-efficacy in learning about cryptoassets

Objective Bitcoin knowledge (actual understanding)

Traditional investment knowledge (self-assessed)

Age: Younger adults feel more knowledgeable

Household size: Smaller households report higher confidence

Compatibility: Higher perceived fit with values reduces confidence

Facilitating conditions: More resources paradoxically reduce perceived knowledge

The correlation between objective and subjective Bitcoin knowledge is strong (r = .486, p ≤ .01), suggesting Canadian consumers are reasonably calibrated in their self-assessment - they don't exhibit dangerous overconfidence.

Interestingly, contrary to other studies, neither education level nor income influenced objective Bitcoin blockchain knowledge.

Why This Matters:

This research has important implications for Bitcoin education and regulation:

Gender Gap: The persistent male advantage in Bitcoin knowledge mirrors traditional finance, suggesting targeted education for women is important to close the gap.

Risk Awareness: More knowledgeable individuals recognize Bitcoin's risks rather than being overconfident - a positive finding, as it shows those potentially being exposed to Bitcoin are aware of potential risks (no overconfidence) -> less need for consumer protection

Age: Young people feel more knowledgeable than they actually are, potentially creating vulnerability despite their technological comfort.

Educational Transfer: Traditional financial knowledge helps with Bitcoin understanding, supporting integrated rather than separate educational approaches.

Wrapping Up

This issue showcases Bitcoin research at its most ambitious and practical extremes. The interplanetary paper demonstrates how Bitcoin's core monetary properties can transcend planetary boundaries through clever engineering, while the consumer knowledge study reveals the very human factors that determine understanding of this revolutionary technology.

Both papers highlight a common theme: Bitcoin's success depends on understanding and working with constraints - whether the speed of light between planets or the psychological factors that drive human learning. The interplanetary research shows how technical innovation can overcome physical limitations, while the consumer study reveals how social and psychological factors shape adoption and understanding.

These findings suggest that Bitcoin's future depends not just on technological advancement, but on thoughtful consideration of human factors and real-world constraints. Whether we're planning for space-based commerce or educating consumers on Earth, success requires understanding both the technical possibilities and the human realities.

I hope you enjoyed reading this issue (whether you are on Earth or Mars).

Until next time—don't trust, verify!