Bits of Bitcoin Research (BBR) - Issue #21

Bitcoin Adoption as a Fractal Strategic Equilibrium: A Theoretical Explanation for Power-Law Growth

Welcome to Issue #21 of Bits of Bitcoin Research, your curated guide to cutting-edge academic insights on Bitcoin.

In this issue, we cover a theoretical paper by Adriano Pecere from Sapienza University of Rome on the adoption of Bitcoin. The paper develops a theoretical mathematical model showing that Bitcoin’s power-law growth pattern can be understood as a strategic equilibrium where individuals, firms, and governments all follow the same fundamental logic at different scales.

Paper: From Local Incentives to Global Power Law Dynamics: Modeling Bitcoin as a Multilevel Adaptive System

Pecere, Adriano. “From Local Incentives to Global Power Law Dynamics: Modeling Bitcoin as a Multilevel Adaptive System.” Preprint, November 2025. DOI: 10.13140/RG.2.2.34945.93289

The Power Law Pattern

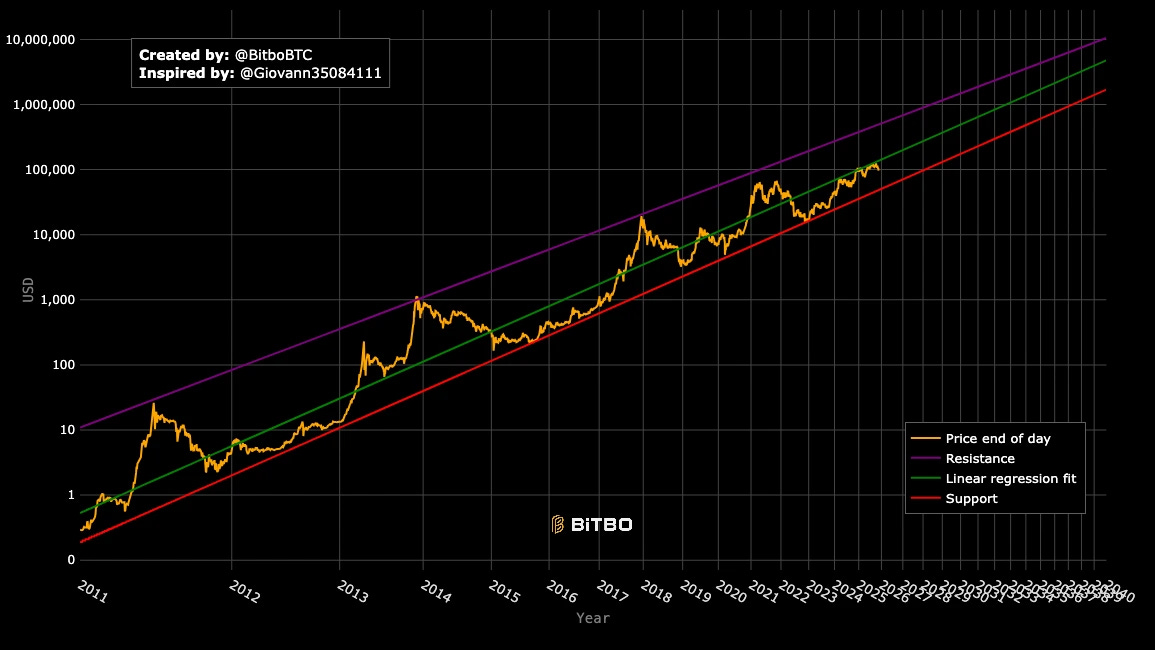

Bitcoin adoption follows a power law: the growth of active addresses, wallets, price, and hash rate all follow the pattern N(t) ∝ t^α, where α is between 1 and 2. This differs from traditional technology adoption models like Bass (1969), which predict S-curves that level off at a fixed ceiling. Bitcoin’s growth doesn’t approach a fixed ceiling, the power law allows continued growth, though at a decelerating rate, with each adoption wave creating space for more expansion.

Why does Bitcoin grow this way? Pecere argues that Bitcoin adoption is a fractal strategic equilibrium. When an individual decides whether to adopt Bitcoin, they weigh the network benefits (more users = more valuable) against costs (learning curve, volatility, regulatory risk). When a company makes the same decision, they do the same calculation—just with different numbers. When a government considers whether to regulate favorably or build Bitcoin reserves, the same logic applies.

The decision-making structure is the same at every level. Individuals, firms, and governments all evaluate: how many others have already adopted, what are the costs to participate are, and what are the benefits from joining. Since this logic is consistent across different scales, just with different-sized players facing different constraints, the growth pattern is self-similar. This self-similarity creates the power law we observe.

The Three-Level Model

Pecere models Bitcoin adoption with three types of agents:

Individuals: private users and investors

Firms: companies accepting or holding Bitcoin

Governments: institutions that regulate or integrate Bitcoin

These levels reinforce each other. Individual adoption creates demand, pushing firms to adopt. Firm adoption generates tax revenue and gives Bitcoin legitimacy, pushing governments to adopt. Government adoption reduces regulatory uncertainty, encouraging more individuals and firms to participate.

These feedback loops work the same way at each level, producing power-law growth. Individual adoption today creates the conditions for firm adoption tomorrow, which creates conditions for government adoption, which feeds back to encourage more individual adoption.

Connecting System Dynamics and Game Theory

The paper’s main contribution is proving that System Dynamics and Game Theory descriptions are mathematically equivalent, they are the same model seen from different angles.

System Dynamics explains feedback loops: more adoption generates more value, which in turn drives further adoption. Game Theory outlines individual strategies: each player decides whether to participate based on expected network effects. Pecere proves these models produce identical dynamics. The sum of individual strategic choices in Game Theory matches the system-level feedback shown in System Dynamics.

Each agent chooses a participation strategy based on network effects (more users = more value), costs (fees, compliance, risk), and expected future value. When agents adjust their strategies over time according to payoffs, the overall behavior aligns with the system dynamics model. The Nash equilibrium, where no one wishes to change their strategy, generates the power law.

Why This Matters

The paper explains Bitcoin’s growth pattern. Most technologies follow S-curves: fast growth that slows down as the market saturates. Bitcoin follows a power law: growth that keeps expanding, though at a decreasing pace. Pecere shows this happens because the strategic logic remains the same at every scale.

For policy, this has implications. Actions that disrupt coherence across levels, such as inconsistent regulation between individual users, businesses, and institutional holders, can diminish Bitcoin’s value. Conversely, actions that maintain coherence across scales support stability.

The framework might work for other decentralized technologies where adoption at one level promotes adoption at other levels.

Critical Assessment

The paper provides a theoretical explanation for Bitcoin’s empirically observed power law. The power-law pattern itself is well-documented, Bitcoin’s price, adoption metrics, and hash rate follow this pattern. What Pecere introduces is the theoretical framework explaining why this occurs: strategic coordination across different scales produces the power law.

Wrapping Up

Pecere provides a theoretical explanation for why Bitcoin adoption follows a power law. By proving the equivalence between system dynamics and game theory, the paper demonstrates that Bitcoin’s growth results from strategic coordination across different levels.

Bitcoin doesn’t saturate like most technologies. Instead, individuals, firms, and governments all follow similar decision logic at different scales, resulting in a continuous power-law expansion. This is important theoretical work that explains an empirically observed phenomenon.

Can the model predict future adoption? Does it work for other cryptocurrencies? Can it explain periods when the power law breaks down? These questions remain open.

For researchers, the paper presents a method for modeling complex systems where individual decisions create macro patterns. For Bitcoin supporters, it offers a theoretical explanation for why Bitcoin adoption doesn’t follow traditional technology adoption curves.

I hope you enjoyed reading this issue. As always—don’t trust, verify!