Bits of Bitcoin Research (BBR) - Issue #14

Bring Only What You Can Carry: Bitcoin's Role in Refugee Wealth Preservation

Welcome to Issue #14 of Bits of Bitcoin Research, your curated guide to the latest insights on Bitcoin.

In this issue, we exclusively cover the new DARI report, "Bring Only What You Can Carry: Bitcoin's Role in Refugee Wealth Preservation," a project I have personally supported.

Because this report addresses a very important yet often overlooked social dimension of Bitcoin, I have decided to dedicate this newsletter exclusively to it, rather than covering two topics as usual.

The humanitarian potential of Bitcoin is a cause close to my heart and deserves more attention, especially as the spotlight has recently shifted towards spot ETFs and corporate treasury strategies.

I'll admit that I carry some bias here, given my involvement in the project, so consider this a friendly nod and an invitation to understand why this matters so much to me.

Before we dive into the findings, I want to give a huge shout-out to Dr. Simon Collins, whose tireless efforts were crucial in completing this research.

Let's delve into the details.

Core Findings

Combining UNHCR refugee population data with national cryptocurrency adoption rates, we used an inference-based approach, estimating that at least 329,000 refugees worldwide have likely used Bitcoin to safeguard or transfer wealth during displacement.

How did we estimate this?

We multiplied each refugee-origin country’s refugee count by its general crypto adoption rate (from TripleA, 2024), then adjusted down to focus only on Bitcoin users (~65% of crypto holders) and excluded those in long-term camps (~22%) with no access to digital infrastructure. This intentionally cautious approach avoids overstating the case and does not include post-flight Bitcoin adoption or unverified anecdotes.

This conservative figure serves as a minimum; there are many valid reasons to believe the actual count is probably higher.

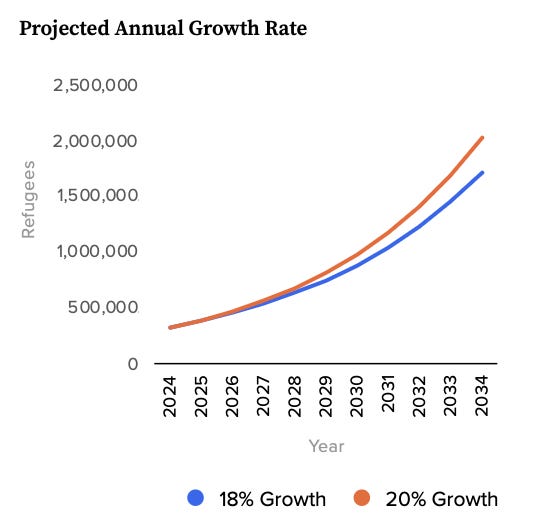

If current trends continue, this figure could reach approximately 1.85 million by 2035, benefitting up to 7.5 million refugees in total.

Note: This forecast is illustrative and could vary significantly due to changes in global displacement, Bitcoin adoption rates, and unforeseen events.

Key insights from the study:

Bitcoin as a Vital Lifeline: Alongside smartphones, internet access, renewable energy, and other essential technologies, Bitcoin is emerging as a crucial resource helping to displaced people survive and rebuild.

Censorship Resistance: Unlike conventional banks that might fail during crises, Bitcoin functions independently, guaranteeing access regardless of local financial system collapses.

Promoting Self-Reliance: Refugees holding Bitcoin may rely less on aid agencies and can integrate more rapidly into new communities.

On-the-Ground Realities: In places like Gaza and the Democratic Republic of Congo, grassroots Bitcoin projects are actively assisting displaced populations.

Unique Attributes: Bitcoin's portability (no physical cash, no ATM queues), borderless nature (accessible without permissions), and ability to preserve value protect refugees from the ravages of local currency collapses.

Advantages Over Other Solutions

Although agencies like the UNHCR have piloted stablecoin cash-assistance programmes (for example, USDC with Ukrainian refugees), such models rely on intermediaries that may fail during displacement conditions.

Most stablecoins are centrally issued and therefore vulnerable to censorship. This could particularly be problematic for refugees fleeing autocratic or sanctioned countries.

Real-World Humanitarian Impact and Examples

Bitcoin addresses crucial shortcomings in the humanitarian response infrastructure across multiple crisis situations:

Bank Failures in Ukraine (2022): During the conflict, traditional banking services ceased to function normally, and capital controls prevented refugees from accessing their savings. For example, when war broke out, "Fadey" was unable to access his funds. However, the Bitcoin stored on his USB drive worked instantly as he crossed into Poland, providing him with money for essentials. "I couldn't withdraw cash at all... the queues were so long, and I couldn't wait that much time," Fadey said.

Aid Delivery in Gaza (2023): Taxi driver Yusef Mahmoud used Bitcoin donations to supply food and fuel to families when traditional banking channels were unavailable.

Microeconomies in the Democratic Republic of Congo: Bitcoin enabled refugee communities displaced by natural disasters to support local economies.

These examples represent a growing yet under-recognised phenomenon that our research quantifies for the first time.

Policy Recommendations

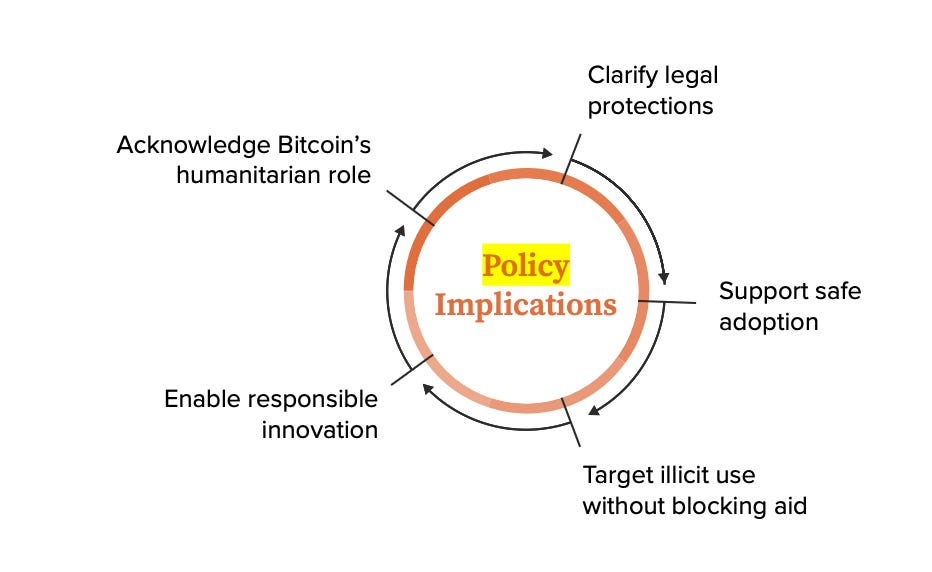

The research identifies five key areas for policy focus:

Acknowledge Bitcoin's Humanitarian Role: Policymakers should acknowledge that refugees are already using Bitcoin and incorporate this reality into digital asset frameworks.

Clarify Legal Protections: Refugees who hold Bitcoin must not face uncertainty or the risk of asset seizures.

Support Safe Adoption: Investment in educational programmes and secure wallet technologies tailored to vulnerable populations is essential.

Target Illicit Use Without Blocking Aid: Regulations should carefully differentiate between criminal misuse and legitimate humanitarian applications.

Enable Responsible Innovation: Facilitating regulatory sandboxes for Bitcoin-based aid delivery could promote effective solutions.

Why This Matters

This report represents the first rigorous attempt to quantify Bitcoin’s role as a financial lifeline for refugees. Although the 329,000 figure is conservative, it clearly shows that Bitcoin’s benefits, such as portability, borderless access, and censorship resistance, are having a tangible impact on a large scale.

Our findings reveal Bitcoin's distinctive advantages in humanitarian contexts:

Easy Portability: i.e., wealth can be moved across borders using a memorised seed phrase.

Borderless Access: Bitcoin operates without reliance on local banking infrastructure.

Censorship Resistance: Hostile authorities cannot freeze it, and capital controls cannot stop transfers.

Peer-to-Peer Nature: Enables direct transfers without intermediaries.

Our study uncovers a blind spot in current regulation: many laws view Bitcoin mainly as a risk rather than a vital humanitarian tool. Yet evidence suggests Bitcoin reduces refugee dependence on aid and potentially eases pressures on host countries.

Looking Ahead

With over 117 million people displaced worldwide, with that number unfortunately rather increasing than going down, and Bitcoin adoption is on the rise; the intersection of humanitarian needs and technology is becoming increasingly significant.

We encourage policymakers, researchers, and aid organisations to recognise Bitcoin not only as a financial tool but also as an emerging humanitarian infrastructure. Investing in data-driven methods and open innovation can amplify Bitcoin’s capacity to support millions of displaced people worldwide.

For Researchers: Notably, this research opens many avenues for further investigation. This study sheds a first light on Bitcoin’s role for refugees; however, significant research gaps remain. Bitcoin’s social and humanitarian potential remains largely underexplored, and more in-depth research is necessary to understand usage patterns, barriers, and optimal practices for adoption in crisis contexts.

If you are interested in conducting research in this field and want to discuss potential research questions, feel free to get in touch.

Special Thanks: This work was made possible by a grant from The Human Rights Foundation. Special thanks to Alex Gladstein for advocating for the cause of quantifying Bitcoin's humanitarian benefits and to the Human Rights Foundation for supporting this research project.

I hope you found this issue insightful.

Until next time — don't trust, verify!

Source:

Collins, S. (2025, July 14). Bring only what you can carry: Bitcoin’s role in refugee wealth preservation. Digital Assets Research Institute. https://www.da-ri.org/articles/bring-only-what-you-can-carry